- REALity Bites

- Posts

- Hit #6 - Marketing: Are You Building Equity or Paying Rent?

Hit #6 - Marketing: Are You Building Equity or Paying Rent?

Welcome to REALity Bites—your go-to source for real, unfiltered insights on brand and marketing (plus other stuff) for good humans in the financial advice industry...delivered at delightfully random intervals.

REALisation - Marketing: Are You Building Equity or Paying Rent?

I turned on my YouTube work playlist this morning and got hit in the face with one of those ads – you know the type - marketing guru, talking fast, promising the world through their "proven funnel system."

So irritating…which inspired me to write this.

I've spoken to a number of financial advisers who have thrown money at 'paid' marketing – Google ads, Facebook ads, fancy funnels from marketing agencies who don’t even understand what financial advisers actually do.

They’ve been disillusioned with the underwhelming results.

And look, I get why business owners go down the ‘paid’ path…they want leads and they want them now.

But, without solid marketing foundations, chasing quick wins is like your clients betting their savings on a hot stock tip from Chad in the office.

The alternative - the organic marketing path - is slower. It's the passive investing of marketing – you need to get the strategy right, be consistent, and let the benefits compound over time.

Let's think about it in terms of renting versus owning your marketing efforts.

Rented Marketing Activities

Paid marketing is like renting – you're throwing money at someone else's property. Social media ads, Google ads, sponsored posts – you're building on borrowed land. The moment you stop paying rent, bang – you're out.

Unless your marketing foundations are rock solid (super specific about your ideal clients, driving traffic to a website that speaks directly to those people with a clear call to action), you'll get leads, but most will be tyre kickers.

I spoke to an adviser spending $6K monthly on Facebook ads. "But Lisa, I'm getting 100 leads!" Cool story. But he's converting two. TWO. That's 98 conversations with tyre-kickers that sucked away time he could've spent doing literallyanything else.

Owned Marketing Assets

With owned assets, you're the landlord. What you build is yours. No one can take away your website, blog posts, email list, videos, guest podcast episodes, newsletter content, social media posts, or signature IP from you. These are all assets that are building brand equity.

I work with another adviser who’s taken the slow-burn approach. He worked out exactly who he wanted to help and what he wanted to be known for. Then he built everything around that – his website, newsletter, social media content – all speaking directly to these people in his way.

He might only get 10ish leads a month, but he's converting 7-8 into clients.

I did maths in the beer garden at school, but even I know that the conversion rate is much better than old mate throwing money at Facebook ads.

Each piece of content you create, every genuine connection you make, every newsletter you send – they stack up. They work for you 24/7, building your authority and attracting people into your orbit who get what you do.

Like investing in quality ETFs that match your sleep-at-night factor and end game, owned marketing assets are a long game where the benefits compound over time.

Think about it like this: Would you rather:

Keep paying rent to Mark Zuckerberg, or

Build something that grows in value year after year?

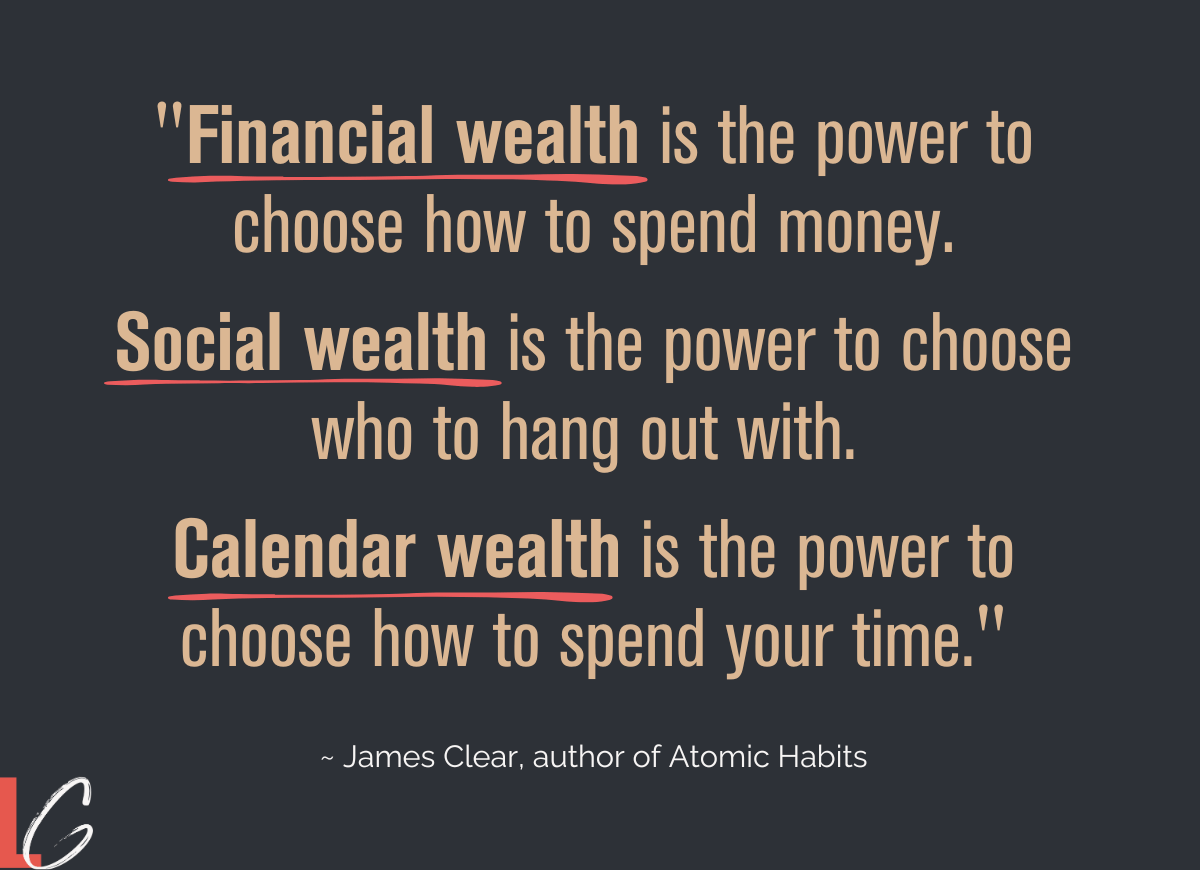

Quote I REALly Like

REALly Useful - Add FAQs to your website

Takes the mystery out of financial advice

Filters out the tyre-kickers

Makes those first conversations more valuable

With the bonus that Google loves FAQs

Take action tip: Your FAQ goldmine is sitting in your sent emails, your meeting conversations and phone notes. Those questions you answer over and over? That's exactly what needs to be on your website.

I’d love to hear your thoughts, ideas, and questions to help make REALity Bites something you’re excited to see in your inbox.

Stay curious

Lisa

P.S. In REAL Life - my interview with Ellen Rogin -

I had a brilliant chat with Ellen Rogin, CPA, CFP® and Abundance Activist® last year. It's a sneak peak into the thinking behind the book I'm writing - Swipe right marketing for financial advice businesses Check out our chat here.

P.P.S. If you know someone who’d find this newsletter useful, feel free to pass it along! They can subscribe here.